When you are employed by a company in Japan, you will join five social insurances if you meet certain conditions.

Let’s take a look at each of them.

Health Insurance

Health insurance provides medical services and cash benefits for injuries and illnesses unrelated to work. It covers not only employees but also their families.

When you are enrolled in health insurance, you do not need to pay the full medical costs when you go to the hospital for an illness or injury.

Additionally, health insurance offers the following benefits:

- High-Cost Medical Expense Benefit: For expensive medical treatments.

- Injury and Sickness Allowance: When you are unable to work for a certain period due to illness or injury.

- Lump-Sum Childbirth Allowance: When you have a baby.

- Maternity Allowance: When you take leave from work for childbirth.

Nursing Care Insurance

When a health insurance member turns 40, they will also join nursing care insurance. This insurance provides care services for those who are diagnosed as needing long-term care under certain conditions.

Employee Pension Insurance

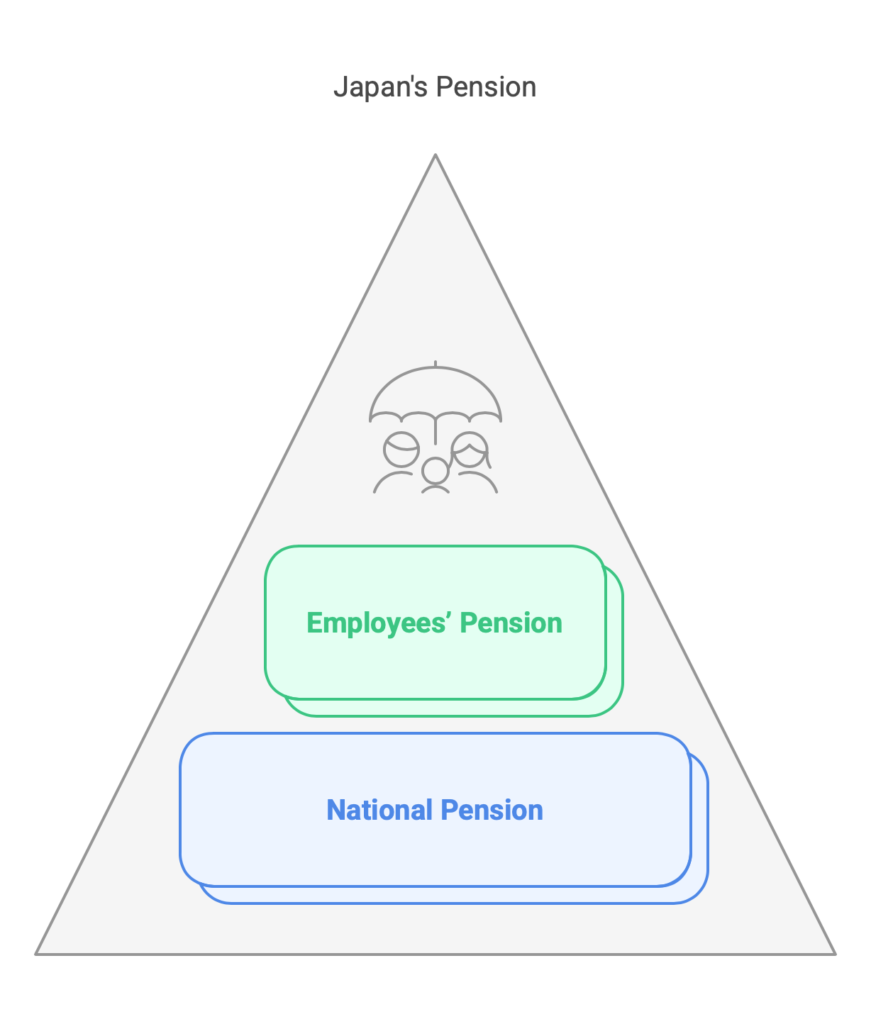

Japan’s public pension system includes the “National Pension,” which is mandatory for everyone aged 20 to 59. Employee Pension Insurance is an additional layer on top of the National Pension.

Employee Pension Insurance covers more than just retirement pensions. It also includes:

- Disability Pension: For those who become disabled due to injury or illness.

- Survivor’s Pension: For the family of the insured person in case of their death.

Employment Insurance

Employment insurance is a system to support workers who are unable to work due to unemployment or leave, and to help them find new jobs.

Employment insurance includes:

- Unemployment Benefits: For job seekers.

- Education and Training Benefits: For those undergoing training.

- Care Leave Benefits

- Childcare Leave Benefits

If you’re working in Japan, improving your Japanese skills can make a big difference in your career and daily life. Many people use italki to learn languages online with professional teachers or community tutors. If you’re interested, check out my detailed article on how italki works and why it’s popular among expats in Japan.

Workers’ Compensation Insurance

This insurance provides benefits for injuries, illnesses, disabilities, or death caused by work-related incidents or commuting accidents.

Key benefits of workers’ compensation include:

- Medical Treatment Compensation Benefit: Provides medical treatment or covers the cost until recovery.

- Disability Compensation Benefit: Provides a lump sum or pension for disabilities.

- Leave Compensation Benefit: Provides benefits from the fourth day of leave when you cannot work due to medical treatment.

- Survivor’s Compensation Benefit: Provides a pension to the family based on the number of survivors in case of death.

- Funeral Expenses: Provides funds for the funeral of the deceased.

- Injury and Disease Compensation Pension: Provides benefits if recovery is not achieved within 18 months from the start of medical treatment.

Conclusion: Why Understanding Social Insurance Matters

When you work in Japan, these five social insurances are not optional—they are part of the foundation that protects your health, income, and future. From medical care and pensions to unemployment support and workplace accident coverage, each system ensures that both you and your family have financial security.

By understanding what each insurance covers, you’ll know what kind of support is available when unexpected events happen. Whether it’s an illness, job loss, or retirement, Japan’s social insurance system is designed to help you live and work with peace of mind.

Comments